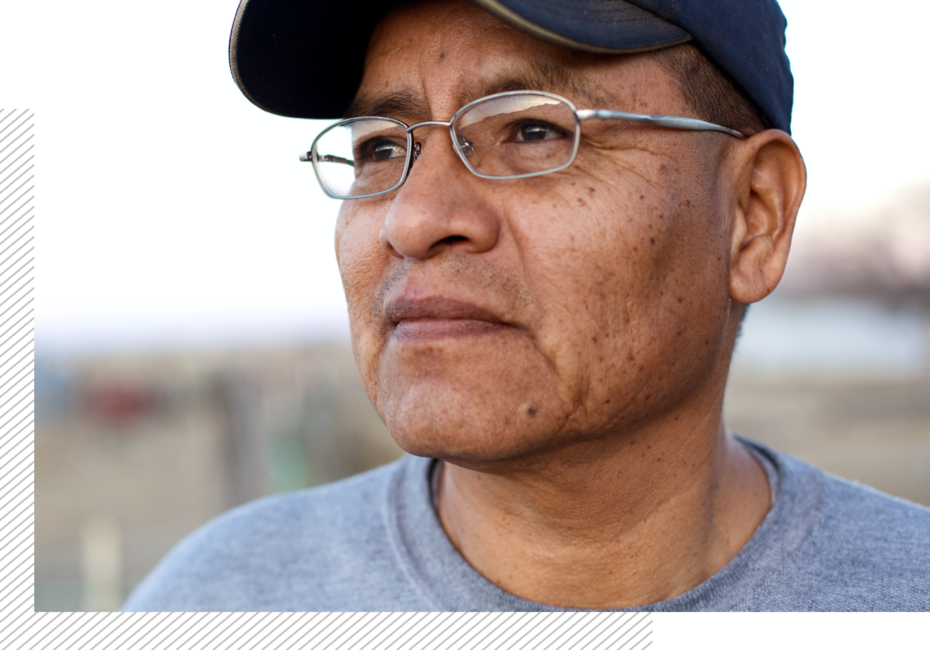

Underserved Communities

Illinois credit unions are making a big difference in underserved communities across our state by providing critical services to many people banks overlook.

Underserved Community Story

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nunc dolor risus, viverra a volutpat in, ultricies nec mauris. Ut hendrerit vulputate dictum. Proin scelerisque semper dapibus. Fusce enim eros, porta dignissim mollis sit amet, pellentesque a lorem.

Sed ut sapien ligula. Nullam rutrum enim turpis, vel elementum felis egestas eget. Ut hendrerit vulputate dictum.

Making A Real Impact in Underserved Communities

For over a century, credit unions in Illinois have made a big difference in underserved communities throughout the state by providing critical services to many people banks overlook.

Credit unions believe everybody deserves a shot at the American dream. We all deserve our hard work to lead to financial stability and peace of mind. We shouldn’t be limited by where we live, the color of our skin, our gender, where our parents were born, what we do for a living, or the language we grew up speaking.

Illinois credit unions are not-for-profit financial cooperatives set up to serve the specific needs of members. They have a specific focus on serving low-income communities—providing lower interest loans, higher savings yields, and lower fees.

In Illinois and across the nation, credit unions create competition in underserved communities that forces banks to offer more services at better prices to lower-income customers. Credit unions in underserved communities around the state also ensure more consumers have access to core financial services so they don’t get victimized by payday lenders, title pawn lenders and currency exchanges charging predatory interest rates and excessive transaction fees.